Growth Structured Settlement

Long-term support, tax-free payment streams

HELPING INJURED PEOPLE MEET TOMORROW'S INCOME NEEDS

A comprehensive structured settlement won’t ease the pain and suffering of a loss or injury, but it can address financial challenges faced by injured people and their families.

Structured settlements can help manage immediate expenses, such as bills and legal fees, but also long-term needs resulting from ongoing medical care or the impact of lost income over time—long-term needs that can be addressed by dedicated payment streams for recipients well into the future.

The Growth Structured Settlement, or GSS, from Assura Trust works hand in hand with a settlement annuity to deliver just that type of long-term support for injured people. It provides tax-free payment streams utilizing a broadly diversified market-based growth portfolio to meet tomorrow’s financial needs—medical costs, living expenses, housing, college education, transportation and more.

- Long-term tax-free income

- Market-based growth

- Inflation offset potential

- Professional administration

BALANCING GROWTH, INCOME AND RISK

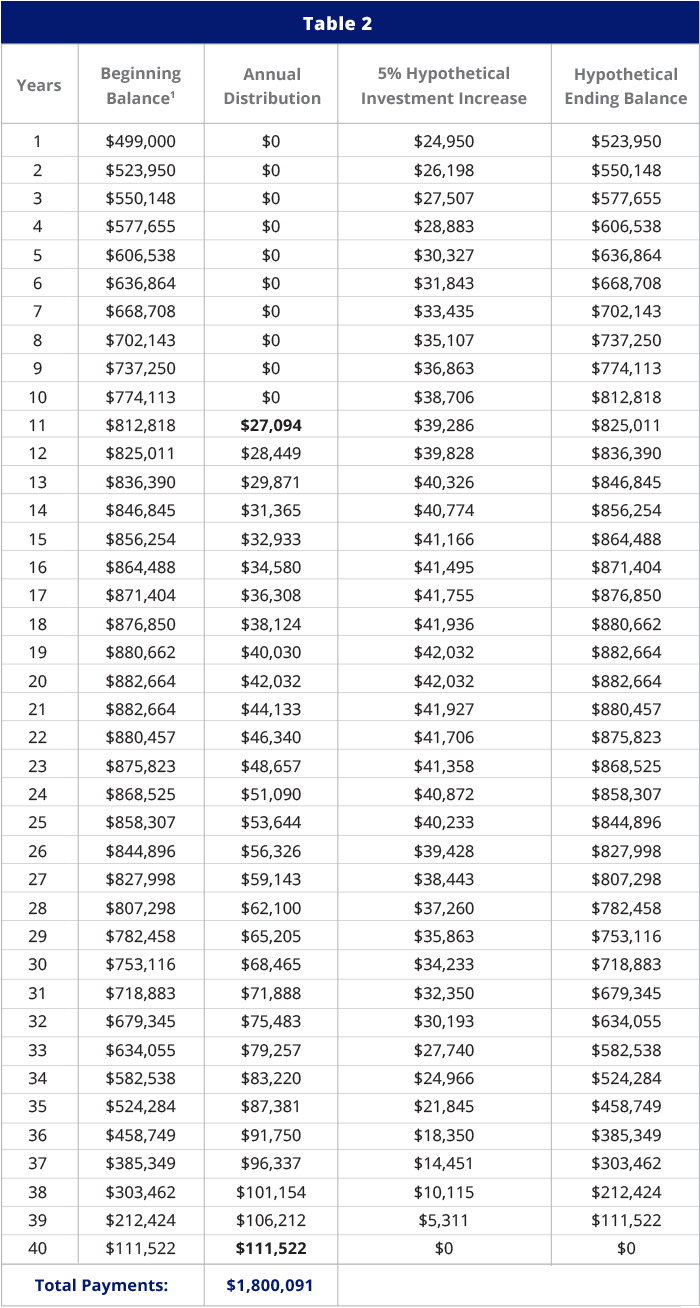

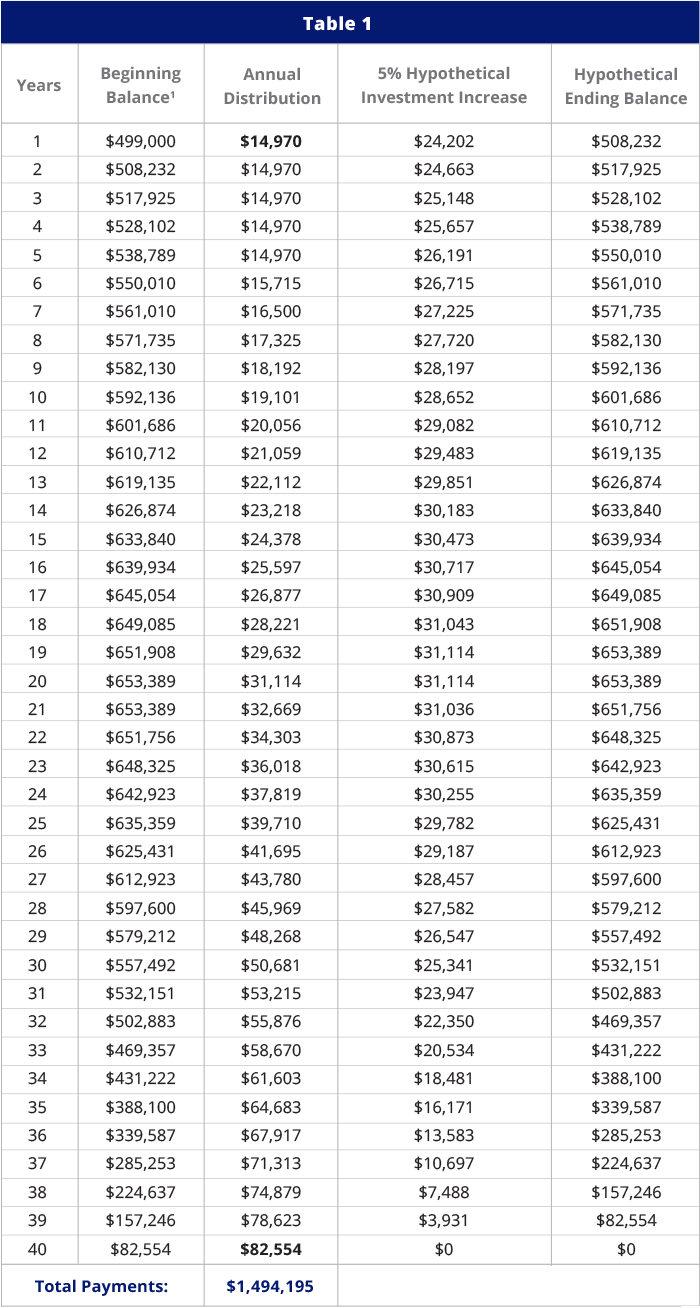

The GSS delivers long-term payments to the recipient from funds in the market-based growth portfolio. When it is first funded, an annual baseline distribution amount is established. Annual payments to the recipient won't fall below that baseline amount as long as there are sufficient funds in the account. Typically, monthly or annual payments are made to the recipient, comprising the total annual amount.

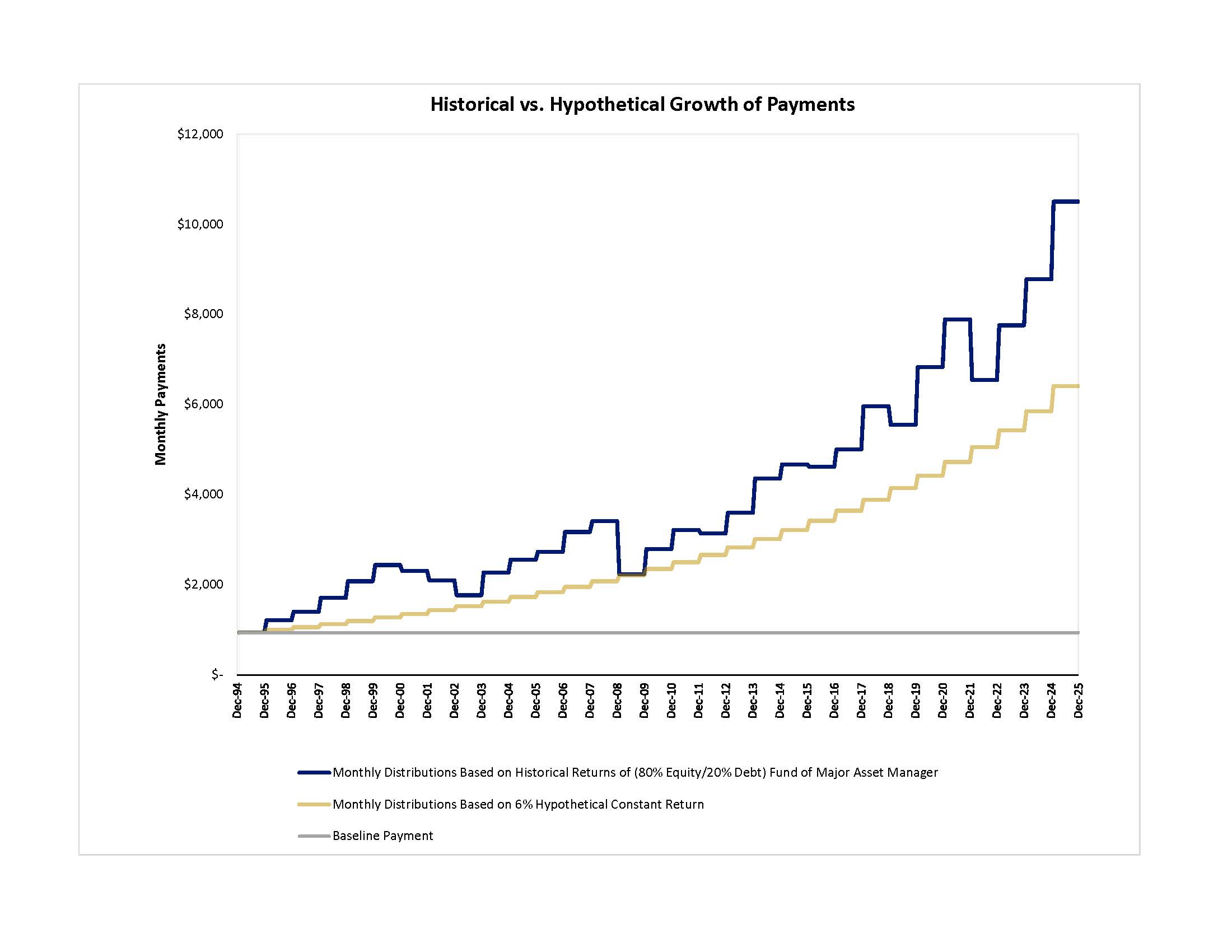

The investment balance each year will go up or down based on the performance of the portfolio. The accompanying chart is an example of GSS (since the fund's inception in 1994) at a historical rate of return reported by the major asset manager as well as a hypothetical fixed 6% return over that time. Changes in payments can be significant and the ability to accept volatility is a consideration.

How the Growth Structured Settlement works

To create the GSS, Assura Trust worked with the largest and most sophisticated asset managers in the world to deliver a portfolio that best suits the needs of settling parties—balancing the mix of growth, income and risk.